The CBRE Cambodia Mid-Year Review 2024 paints a positive picture of Phnom Penh’s evolving real estate market, showcasing growth across office, retail, residential, and industrial sectors. Key findings reveal steady progress despite challenges, underscoring why the capital remains a compelling destination for real estate investment.

Key Market Insights

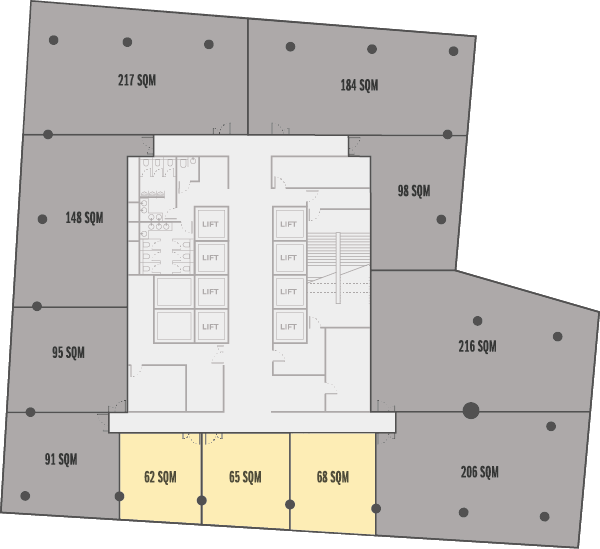

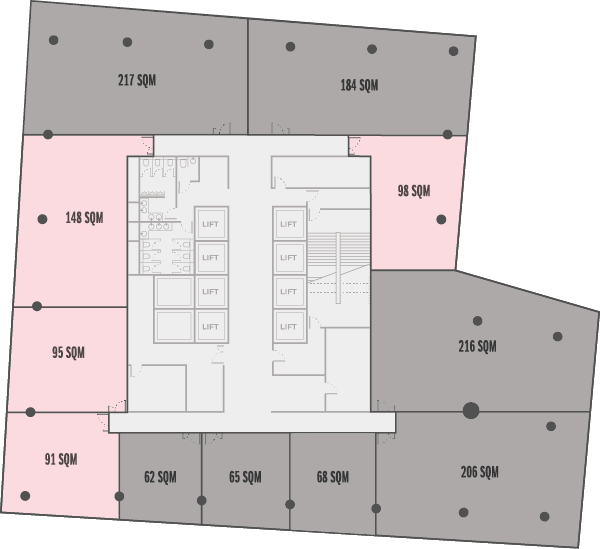

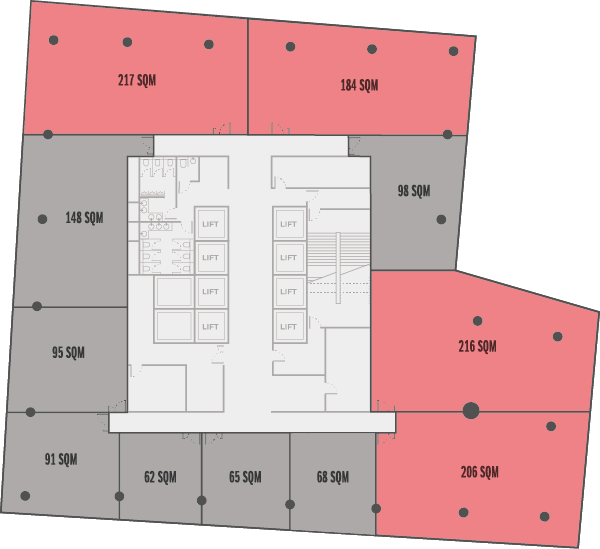

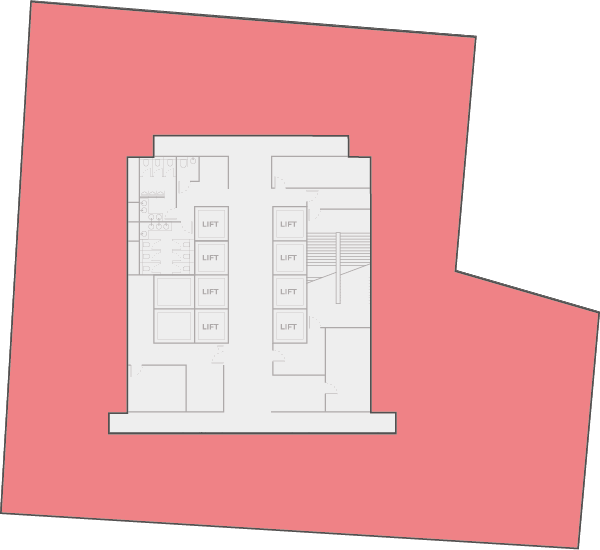

- Office Sector: Occupancy increased to 61.8% in H1 2024, and rental rates are USD 25-30/sqm, significantly more affordable than those in neighboring countries in the region.

- Retail Sector: Occupancy is 58.7%, and rents average USD 25/sqm, presenting a cost advantage over neighboring markets.

- Residential Sector: Phnom Penh offers the most affordable condominium prices in Asia at USD 2,500/sqm, with attractive rental yields of 5.3%.

- Sustainability: Cambodia has only 28 LEED-certified projects, compared to hundreds in Vietnam and Thailand.

ODOM is uniquely positioned to leverage these market dynamics as a premier mixed-use development. Its Singapore standard Grade A office spaces provide businesses with affordable, high-quality infrastructure in the center of the city.

ODOM is uniquely positioned to leverage these market dynamics as a premier mixed-use development. Its Singapore standard Grade A office spaces provide businesses with affordable, high-quality infrastructure in the center of the city.

Retail spaces cater to growing demand from local and international brands, and its modern residential offerings align with the increasing appeal of urban living in Phnom Penh.

Retail spaces cater to growing demand from local and international brands, and its modern residential offerings align with the increasing appeal of urban living in Phnom Penh.

Most notably, ODOM is pursuing LEED certification, setting a benchmark for sustainable development in Cambodia. This eco-conscious approach positions ODOM as a forward-thinking investment for tenants and buyers prioritizing sustainability.

Most notably, ODOM is pursuing LEED certification, setting a benchmark for sustainable development in Cambodia. This eco-conscious approach positions ODOM as a forward-thinking investment for tenants and buyers prioritizing sustainability.

With Phnom Penh’s real estate sector on a path to recovery, ODOM’s strategic location, competitive offerings, and sustainability focus make it a standout opportunity in an emerging market full of potential.

With Phnom Penh’s real estate sector on a path to recovery, ODOM’s strategic location, competitive offerings, and sustainability focus make it a standout opportunity in an emerging market full of potential.