1. Determine Your Budget

Be financially prepared and factor in not only the purchase price but also other expenses that may be involved, such as closing costs, taxes, and any maintenance fees. You should have enough in savings to cover both down payment and closing costs. Double-check your personal credit situation and keep an organized file of all financial information you might need. This will help you narrow down your options and avoid overspending.

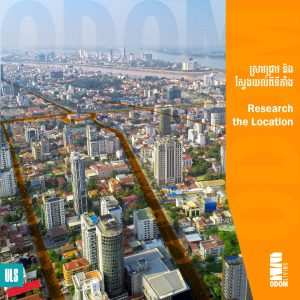

2. Research Your Location

Take your time. Make sure you’ve done your homework and research different neighborhoods, schools, and nearby amenities within the area. It’s alright to be selective, but remember, not all locations were created equal. Be prepared to walk around and scope out the neighborhood and focus on the amenities that are vital and convenient to you. Look for a home in a location that fits your lifestyle and keep that in mind over the course of your search for a new home.

3. Take Your Time

Don’t feel pressured to rush into a decision. View multiple properties, compare features, prices, and weigh the pros and cons before making your final offer. Team ODOM understands buying your 1st home is a huge decision. We offer guided tours of the residential mock-up units and personalized service to make your experience as seamless as possible.

Contact us today and speak with our friendly Sales & Home Advisors to learn more.